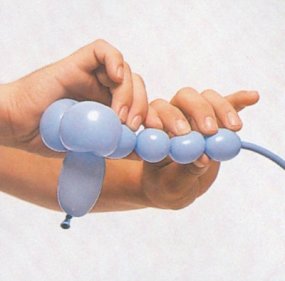

For those that wish a more easy to understand template for what is happening to the financial markets of the nations today, and also just what inflation causes and what its eventual result in all cases must be, we must try and metaphorically consider the so-called “economy” as a ballon. Some may say it’s a bubble, or that it is full of sector-based bubbles like the exploding and then imploding tech bubble not so long ago. Remember that now president Trump, in his pre-elections speeches, declared the whole economy to be essentially the result of a massive “bubble” about to burst (paraphrase). Now he uses those same, insubstantial bubbles to declare that his administration has improved the economy. But so would any president of any corporation take credit for this scheme. It’s just business. And the king must have his pretended glory.

Please understand that for the organized criminal element of the commercial government, banks, and its institutionally stock-owned corporate, commercial world, inflation is a wonderful tool. It works! For them…

But Confuses say: that which inflates must also deflate. Well, not really. But I’m sure that’s what he would say. What goes up must come down, etc.

The problem with deflation is that, unlike inflation, which pumps artificial value (form with substance) into the “economy, deflation represents the destruction of both that artificial value plus the actual (market) value as it deflates back to nothingness it was built upon. In other words, the foundation of the market is not inflated, only the overhead space above it, so that the market appears stronger than it is. But when the deflation hits, it takes the foundation down with it. In sound engineering and editing we might call this as compression. To create inflation, first compress the foundation, then bring it back up so that its “volume” is louder but not necessarily of any more substance.

So let us now consider the ballon. What is actually happening to the ballon with inflation? It is not that more air (substance) is being pumped into the ballon, it is that inflation squeezes and tightens the ballon to the point where it appears to expand, and is then tied off. What remains after the tie is the True effect of inflation of the form, which is deflation of the substance. This never-ending cycle of the cause and effect of pumping in false value and then pumping out Real assets (as value) is called reflation. Once the initial inflation happens, and the necessary compression and detraction of deflation results, each new cycle is a reflation.

But what is reflation?

Reflation is the process of that squeeze and tie off of the ballon, until eventually only a small part of the balloon is actually inflated, the rest lying dormant and without substance. The ballon is compressed, leaving even more empty form, and that compression expands the lie that is the appearance of wealth and prosperity. The “economy” (compressed ballon) appears to be just as large as it was 10 years ago, and yet even bigger from completely unsubstantiated “growth” (false valuation). But the fact is that it’s only the elasticity of that ballon (economy valuation) that has now been squeezed so extremely tight that all the real or actual value of the original substance is so low as a percentage of the balloons’ actual value (substance) compared to the injected filler, the false value (form) caused by inflation. In other words, the economy is full of hot air. It’s like a 10×10 foot box that is filled with Styrofoam all to hold and protect a single, minuscule small coffee cup. And I think most people at some level deep down already know this to be True.

The problem we are seeing today is that these current attempts at reflation are having none or little effect on the actual market, because most of that small amount of actual market valuation is already a result of the inflation process. In other words, there are no ice cubes left in the glass to float when the glass is filled with water. There’s no more room or elasticity to inflate and crimp the rubber walls. And any newly infused inflation does not cause the actual value to increase anymore, just remain stagnant. The growth is artificial, no longer effecting the bottom line. There is just not that much actual wealth left to prop up. The ballon is so tightly squeezed that its about to pop.

So what does our current economic ballon basically look like? It looks like this massive, overstretched air bubble at the very tip of the ballon, while the majority of the actual balloon is completely depressed (deflated). The real wealth has already been extracted, leaving a bubble unrooted to any foundation.

–=–

Are you grasping the metaphor?

Can you see where there once was inflation, now there is devaluation (depression),

while reflation causes it to appear the same size in form without substance?

–=–

Oh, and here’s what the “tech bubble” looked like in 2007,

Only you have to imagine the empty tail of this stinking rat to go on another 10 feet!

Awe, how cute. I’m Joe public. All I really see is a cute little ballon animal.

–=–

Meanwhile, so as to extract all of the public wealth out of the public sector

and into the hands of government and corporate money-changers,

here we see a behind the scenes look at the real movers and shakers of these bubbles.

That’s a bed of nails, in case this isn’t clear.

–=–

But don’t worry. Be happy!

For as your entire wealth and prosperity is being drained

like a bunch of hot air from this economy you love so much and have gambled

your whole life and retirement upon, government is allowing other types of

legal glass bubbles that are enjoyable for one and all…

These stylish bubbles are guarantied to make your

half-gram or 1-ounce investment get you feeling even higher as well,

at least, while the effects of the bubble last.

Note: resealable baggies can be blown up like bubbles too!

I also enjoy bubble wrap.

And Congress says:

Be a doper or a crackhead, your choice. Just stay out of our business!

Meanwhile, let us suck your investments funds dry

like a delicious, artificially flavored Slurpee from 7-11

so that we can continue on with the war on drugs.

–=–

In conclusion, we are being exposed to two types of extremely mind-altering bubbles here, and it may very well come to pass that only the users of the second type may not feel the need to kill themselves or even notice the economic depression that will happen because of the first type. It’s a correction, they tell you. We must correct the inflated markets. Duh! You inflated them, assholes, with the intent of stealing any actual wealth, replacing it by toxic-debt-instrument-backed pretend reflation, and now you are playing Captain Obvious?

This is not a confession by these organized criminals, mind you, just a bit of business-as-usual, social programming-based disclosure that our public psychological tests show most people will just sit back and watch it happen. They will even speak of it as if it’s normal, or as if they know how and why it happened.

What’s so damned funny about this little practical joke called the market economy is that all that wealth, all that real estate, all those foreign exchange certificates and bonds, all those precious metals, and all of every other possible asset made contracted or incorporated and thus redeemable since the dollar got turned into the worthless fiat shit-show it is today, the dollar of course being the most extreme example of an over-inflated bubble imaginable, has all but been removed from the value markers of all these investment and debt instruments. In other words, if the stock market crashes tomorrow, the truth of the matter is that if all stocks went to $0.0, this should not effect in any way the actual corporate structure of that which the stock supposedly represents. The stock and its value is so distant, so detached from the actual company and its business dealings and earnings, that everything could just crash go on as usual, except that the stock market would be gone.

But it’s not that simple. Here’s the real problem: The only way for governments and corporations to make profits and gains is to invest in stocks, bonds, and other debt instruments. On paper, at this moment, a corporate stock may be trading at and therefore artificially valued $100.00 per share. But that’s only if you are holding the stock itself. To realize that price, the holder must do one of two things. Sell the stock, or use it as collateral, as a false equity, so as to acquire the value of that stock in the form of a loan against it. For if one institutional holder sells the stock, this may trigger others to start the same sell-off, bringing the completely artificial market price of the stock and the market itself, which represents the artificial bubble based on the artificially reflated prices with nothing of substance backing them, into what we are entrained to call as a crash, as if it was an accident the could not be avoided.

But make no mistake, my fellow debt-slaves. When this happens, every time it will happen and has happened in the past, this is nothing more and nothing less that exactly what by now you should have figured it out to be, a well-orchestrated extraction of trillions of dollars of wealth from all of us by replacing real assets with paper ones. This is not a correction, it is the greatest continuous wealth exchange in history. It is the virtual selling of all public assets and shareholder control to government and corporations (institutional investors). It is the communistic takeover of the entire economy and public and private wealth. It is the final flight of the phoenix burning to the ground and emerging as that New World Order we all love to drone on about but never do anything about.

Remember. It’s all a practical joke. It was designed to fail, because failure to us is access to them. Try not to take it so seriously. It’s just fiction in the end.

Thank you for attending this Red Pill Sunday School once again.

Look out for my next post, here, which will be a large section of my 2nd book, titled for this blog as:

Replacing “God” With “Logos” – The Most Unholy, Logical Fallacy

Just in the final editing now, coming in at over 125,000 words so far, and certainly designed to both enlighten, cause unwarranted controversy, and generally piss you off like only I can with the Truth, not to mention keep you busy for a while.

Until then, fare thee well brothers and sisters. Why not grab a lawn chair, a bong or fruity cocktail, and an oversized umbrella so we can watch the best shit-show on earth together, the completely staged, global economic meltdown, sponsored by the Congress of the United States and its investment strategy and stockholder portfolio that most of you have no idea even exists. But why learn now that governments own all corporations by ownership stock holdings in those companies while also passing all the laws that give those corporations license and permit to be total dicks? The deed is done, and so if you’re a nationalist you should be happy about this. For the corporation nation that is the commercial “United States” along with its United Nations partners is about to take control of the entire economy in one fell swoop. That’s what stockholders receive, for they won’t be selling but buying what you and your agent sells. And what care does government have if its economy crashes if in the end it stands collectively with the other governments of the world as the majority owner of the entire corporate structure and the almost totally privatized public infrastructure?

I think I’ll go watch The Corporation Nation (15 parts) and The Great Pension Fund Hoax again for posterity, and to say: see, I told me so.

.

–Clint richard-son (Realitybloger.wordpress.com)

–Tuesday, October 30th, 2018

Doreen Agostino

/ October 30, 2018Thank you Clint. The truth about: Public Private Partnerships = New World Order global enslavement https://vimeo.com/297140596

LikeLike

futuret

/ October 30, 2018http://endoftheamericandream.com/archives/shock-claim-the-media-is-reporting-that-some-in-the-2nd-migrant-caravan-have-guns-and-bombs

LikeLike

James kong

/ October 30, 2018Thanks to crrow777 I found you. When I’m working I listen all day. Clint. Did you kill 130 gooks ? ( btw???) How can I thank you when all you’ve done is do everybody’s fucking homework for life. I’m here in far rockaway ny. And I get this urge to move to Utah just so I can have a dear friend close by. I am your friend for life. Cheers.

LikeLike

realitybloger

/ October 30, 2018The best way you can thank me is to help and teach those where you are at. Distance is not a factor when True Love and Friendship is involved, and those who need help are usually those adversarial to us, not those already listening and friends. I still hope and even plan to help bring the like-minded together, to separate from such cities we are stuck in. I hope you’ll stay in touch and be one of them. Contact me anytime if you need to talk. Thanks. -Clint

LikeLike

marcwasson

/ October 30, 2018Hey Clint, this is Marc your good old flat earth buddy. It still amazes me on how you get so much spot on but you just have a blind eye to the biblical cosmos. I look forward to your new book. Take care,

LikeLike

realitybloger

/ October 30, 2018Marc, you misunderstand my disposition, that’s all. I have never seen the cosmos, and neither have you. That’s the only Truth. Therefore, I care not what shape of from it is, only that its substance Exists and causes mine and your Existence. I don’t waste time on that which I can never know, only to respect and Love the mystery of It all. I enjoy the mystery of that which man is not supposed to know or experienced in this life. You should try it sometime, instead of insisting knowledge of that which cannot be known. Enjoy the view from this limited vantage point and let fools argue over what they believe but can never know. I care only that here on Earth I have everything I need to support and sustain myself, but a bunch of a-holes are destroying it. I know my place, and my place is not as God or to pretend knowledge and perspective only God may know. If that bothers you, that I have learned to once again accept and worship the mystery of things that I cannot know or change, flat or round as they may be, then I hope that somehow you may finally find the peace I feel in not knowing is some other way. Meanwhile, I’ll call you my bother and hope you fulfill that duty as I will to you. -Clint

LikeLike

marcwasson

/ October 30, 2018Yes, well said and I will enjoy having you as a brother. I believe in Jesus and his Scriptures in the Bible and many other books such as Enoch. I can’t prove what I believe, yet I somehow know it in my Spirit. However, I can prove that there is no curvature. Large bodies of water are demonstrably level. The question really is why the lie? The people that promote the lie of the globe and space and the heliocentric narrative are the a..holes you speak about that control those other deceitful narratives you so hate. But I’m not in distress about it or you not seeing it yet…Really. Much Love and Peace.

LikeLike

futuret

/ October 30, 2018THE DOLLAR IS NO LONGER THE WORLD’S RESERVE CURRENCY, COUNTRIES ARE NOW TRADING IN THE CHINESE YUAN, AND SOME IN THE EURO. EVENTUALLY IN THE VERY NEAR ANTICIPATED TIME, ALL COUNTRIES SHALL TRADE IN THE YUAN. YES!!! YOU ARE ABSOLUTELY CORRECT:

https://www.thecommonsenseshow.com/hr-1111-the-democrats-and-the-un-plan-to-seize-control-of-the-government/?utm_source=rss&utm_medium=rss&utm_campaign=hr-1111-the-democrats-and-the-un-plan-to-seize-control-of-the-government

LikeLike

Everything is backwards

/ October 30, 2018You threw precious metals into that True horror story. Are you saying their worth is in jeopardy?

What’s so damned funny about this little practical joke called the market economy is that all that wealth, all that real estate, all those foreign exchange certificates and bonds, all those precious metals, and all of every other possible asset made contracted or incorporated and thus redeemable since the dollar got turned into the worthless fiat shit-show it is today, the dollar of course being the most extreme example of an over-inflated bubble imaginable, has all but been removed from the value markers of all these investment and debt instruments.

Ginny

LikeLike

realitybloger

/ October 31, 2018You have to understand there will be no exchange to set a price of gold in a crashed economy. So your precious metals will be worthless metal trinkets, unless you can find a fool that will accept them for that which will sustain you. Maybe those in the patriot movement and Fox News watchers will exchange something for nothing.

You must also understand that government doesn’t give a shit about how much metals you possess, because it is not part of what I am about to show you. In other words, it is not part of the special government stash that was collateralized (not backing) to the dollar. It’s their system, and they set the rules and values.

Let’s take gold for our example.

The “lawful” price of gold has been set by Congress and has not changed in many decades.

We are mostly kept unawares of the lawful set price of gold, and are only induced by the “market” or speculated (commercial) price. This is artificial in every way, having nothing to do with the actual asset of gold, only its legal value in mammon.

IN other words, when the economy crashes, the government is left holding the same amount at a set value recognized by the law of nations of gold at the same value they set for it as collateral.

The government can say your gold is only worth 1 dollar an ounce, while its statutory price remains at $42.222. It will then be happy to purchase (conquer) voluntarily or by confiscation what you have, since it is basically worthless because there is no market value and it does not qualify as statutory (collateralized) money.

If you have 20,000 dollars worth of gold today, what will that gold be worth in dollars when the dollar “resets” “crashes” or “corrects” — which are all basically three options of the same scheme? What’s a billion dollars worth of anything if the dollar isn’t worth anything?

Perhaps you know of some other value for gold I am unaware of? Bitcoin has value why? Because it can be traded in dollars. It’s even valued in dollars? So what will it be worth? The same as gold. Unless you are that lucky, statutorily reserved and carefully measured gold reserve that government has stashed tightly away for just such occasions, stuck for almost a half century now at $42.222.

I hate to break the news, but the only way to have a stable economy in a nation is to statutorily set the price of money. That’s why government is just fine, while we who worship the “free market” are basically a casino idiots in debtors’ hell.

If you have 10 rolls of toilet paper and 10 1 ounce gold coins after the crash… I’ll take your toilet paper and leave you your trinkets. And I’ll at least be able to wipe my starving ass for a while, one of the many strange, modern comforts we will learn to miss.

If you don’t understand, the Fed explains it very well, since it holds the gold certificates on behalf of the government, and is allowed to trade (use as credit/debt instruments) them as collateral at market value by law. Organized crime at its best.

I suggest you read this page from the Fed website, which is confirmed in the CAFR:

https://www.federalreserve.gov/faqs/does-the-federal-reserve-own-or-hold-gold.htm

“The Gold Reserve Act of 1934 required the Federal Reserve System to transfer ownership of all of its gold to the Department of the Treasury. In exchange, the Secretary of the Treasury issued gold certificates to the Federal Reserve for the amount of gold transferred at the then-applicable statutory price for gold held by the Treasury.”

Gold certificates are denominated in U.S. dollars. Their value is based on the statutory price for gold at the time the certificates are issued. Gold certificates do not give the Federal Reserve any right to redeem the certificates for gold.”

“The statutory price of gold is set by law. It does not fluctuate with the market price of gold and has been constant at $42 2/9, or $42.2222, per fine troy ounce since 1973. The book value of the gold held by the Treasury is determined using the statutory price.”

subtext (note 1)

“1. The reported value for “gold stock” is not the same as the reported value for “gold certificates.” By law, the value of gold certificates held by the Federal Reserve must be less than or equal to the book value of gold held by the Treasury, and the Treasury has not issued gold certificates against all the gold it owns. In 2002, the Treasury set aside a stock of 100,000 fine troy ounces of gold to help ensure that the book value of gold held by the Treasury would always exceed the value of gold certificates held by the Federal Reserve. This stock, which is sometimes referred to as “unmonetized” gold, has a book value of $4.22 million.”

LikeLike

futuret

/ October 31, 2018THEIR MAIN GOAL IS TO IMPLEMENT THE MARK OF THE BEAST, NOTHING FROM NOTHING WILL NOT HAVE ANY MEANING NOR VALUE. A TRANSACTION WILL BE ONLY AN ABSTRACT REPRESENTATION OF WHAT A PERSON HAS, AND DIGITAL SHALL NOT BE FELT IN FORM OF COINS, CURRENCY, NOR CARDS, BUT A CHIP PLACED UNDER THE SKIN OR A TATTOO OF ELECTRONIC INK PLACED ON THE FOREHEAD. THE ENTIRE GLOBAL SYSTEM OF MONEY FROM EVERY ANGLE SHALL BE DESTROYED FOR THIS PURPOSE, AND IT SHALL NOT BE REVIVED AS WE KNOW IT TO BE. THIS PROCESS IS BEGINNING WITH US AS WELL:

https://socioecohistory.wordpress.com/2018/11/01/world-dumping-us-debt-hoarding-gold-de-dollarization-explained/

LikeLike

Harry's Pretzel Mug

/ March 22, 2022Currently, there’s a scheme to fully reset America’s financial system at the federal level. This makes an interesting read. If accurate, it details a sobering move to liquidate what little monetary freedom we have left. It’s similar to China’s social credit system, except arguably much worse depending on who you ask. And, of course, it involves the use of blockchain technology. We all know what that means.

“Physical currency likely will be phased out entirely over time, in favor of a digital format controlled by the Federal Reserve. The ubiquity of cell phones and scannable codes will make integration of a digital currency, under some form of the blockchain, relatively easy to implement. This soft-nationalization of the banking sector would leave the United States in uncharted waters. Nearly every transaction, from political donations to purchases as seemingly insignificant as a pack of gum, would be visible to the government and subject to scrutiny. Government regulations could block or track certain transactions with no trial or public recourse. Even worse, if you were placed on a list by a federal bureaucrat – not a judge – your access to banking and credit cards potentially could be shut off without a warrant or trial.”

https://www.msn.com/en-us/news/politics/the-coming-federal-weaponization-of-banking/ar-AAVnaHA?ocid=msedgntp

To be frank, however, we already use a digital currency system for most of our financial dealings. If I remember correctly, about 97% of all our commercial transactions are virtual, and less than 3% are physical. Joe Biden is essentially expanding an already existing market by including crypto-currency under this scheme, which gives federal agencies like the Federal Reserve and the Treasury Department more leeway over how their property – money – is used.

LikeLike

New Human New Earth

/ October 30, 2018ESSENTIAL KNOWLEDGE FOR EVERY AMERICAN TO KNOW FROM ANNA VON REITZ

https://www.newhumannewearthcommunities.com/tda_accounts/essential-knowledge-for-every-american-to-know-from-anna-von-reitz

LikeLike

Doreen Agostino

/ October 31, 2018CONVERT YOUR WEALTH: While it still has value. Q&A with Lynette Zang and Eric Griffin https://youtu.be/0-62Qw879WY

LikeLike

julienow

/ November 12, 2018speaking to crypto currency, here’s a wonderful explanation of the fraud behind it. there’s so much more research by quinn michaels, highly recommend his presentations.. https://youtu.be/jEWm1OOHLkw

LikeLike

John Andrew

/ December 6, 2018Hi Clint have ever heard of David Williams ? He use to have a YouTube channel called Matrix Solutions but now goes by 3Keystofreedom.com he knows all the same things as you do and has been doing this since 1999 somewhere around there . He has done a lot of interviews which you can find on YouTube and says he knows how to put everything into action to get out of the system. Check him out and see what you think.

LikeLike

realitybloger

/ December 21, 2018Thanks John. Heard the name around but have never checked him out, or vetted him. Will do so.

-Clint

LikeLike

John Andrew

/ December 21, 2018Hi Clint I did some vetting and watched his latest video and I was not at all impressed only to find out he is still in commerce and to see it is all about business with him and this association he took over sounds , looks and smells like he is working toward the one world religion . As far as I can see you , Daniel , Arthur Christian are the only ones talking the talk and walking the walk. I downloaded your book already , still reading through it but a lot of great info in it.

LikeLike

Doreen Agostino

/ December 9, 2018Remedy To Global Challenges Template: Court File No. T2068-18 Canada

The following link provides a ‘template and action plan’ for people in democratic countries to introduce a lawful, peaceful process to remedy global challenges. Please read and share.

In Canada, please join the CPU, e-sign the Convention of Consent and inform others as follows. Thank you. https://ourgreaterdestiny.wordpress.com/2018/12/07/remedy-to-global-challenges-template-court-file-no-t2068-18-canada/

LikeLike

Harry's Pretzel Mug

/ February 23, 2022This is just as important today as it was over three years ago, with the current saga about rising inflation during the present scamdemic.

LikeLike